FRESH BANANA EXPORT PROCEDURES AT SMARTLINK

With its great potential and increasing market demand, Vietnamese fresh bananas are attracting significant attention from businesses. However, to successfully bring this product to the international market, enterprises must overcome many administrative and quality standard barriers. This article will help you better understand the fresh banana export procedures, from preparing the goods to completing customs procedures, enabling you to confidently conquer the international market with quality fresh bananas.

Fresh Banana Export Policy

According to Appendix II of Decree No. 69/2018/NĐ-CP dated May 15, 2018, fresh bananas are not listed among the goods prohibited for export to foreign markets.

However, to ensure quality and biosecurity, fresh banana exporters must comply with plant quarantine regulations. As per Circular No. 15/2018/TT-BNNPTNT dated October 29, 2018, bananas must undergo plant quarantine before export.

HS Code and Export Tariff for Fresh Bananas

HS Code

Exported bananas are classified under group 0803 – “Bananas, including plantains, fresh or dried.” Depending on the type of banana, the specific HS codes are as follows:

- Fresh bananas: 08039090

- Plantains: 08039010

- Banana leaves: 08031000

Export Tariff

According to current regulations, the export tariff applied to fresh bananas is as follows:

- Export tax: 0%

- Value Added Tax (VAT): 0%

Fresh Banana Export Procedures

The fresh banana export process includes the following key steps:

Step 1: Research HS Code Information and Export Tariff

- Determine the correct HS code for fresh banana products.

- Be aware of the applicable export tariff.

Step 2: Check Import Permission at the Destination Country

- Ensure that fresh bananas are allowed for import into the target market.

- Understand the specific requirements and regulations of the importing country.

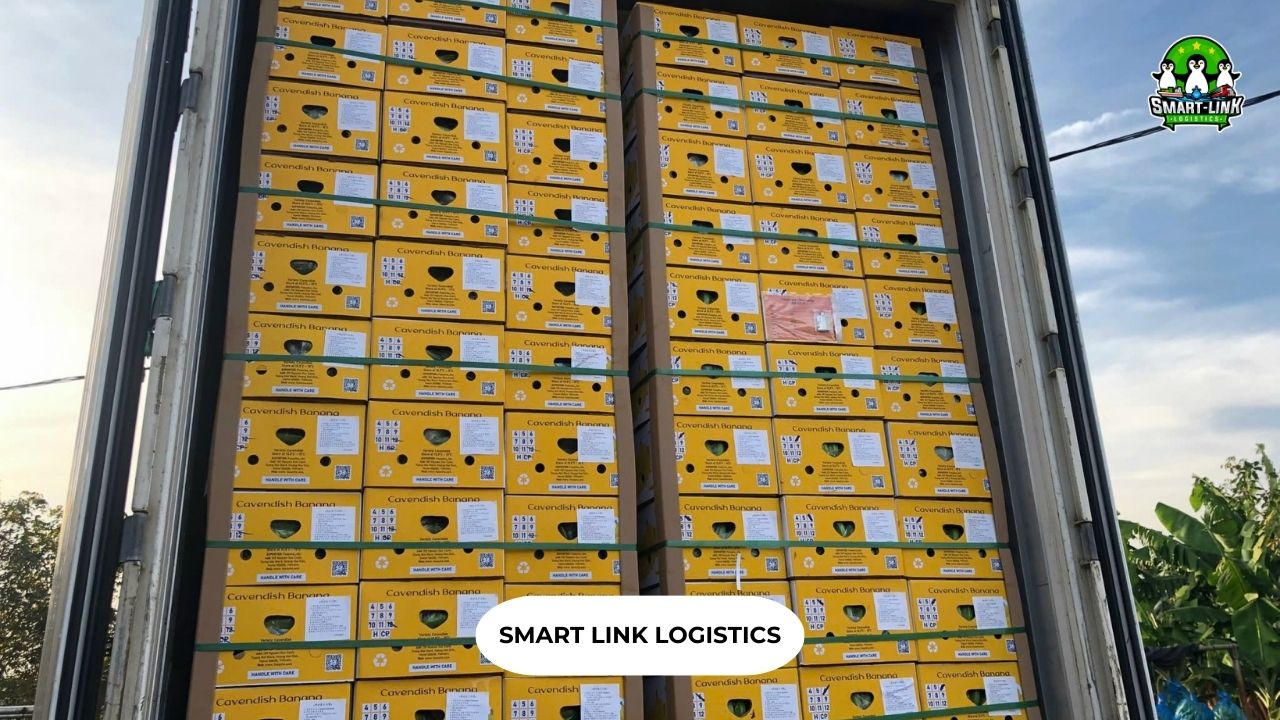

Step 3: Prepare Goods and Arrange Transportation

- Book appropriate shipping vessels or transportation methods.

- Prepare goods according to the order requirements.

Step 4: Register for Plant Quarantine

- Carry out plant quarantine procedures in accordance with regulations.

Step 5: File Export Customs Declaration

Prepare and submit the necessary documents, including:

- Commercial contract

- Commercial invoice

- Packing list

- Customs declaration form

- Bill of Lading

- Phytosanitary Certificate

- Other required documents (if any)

Step 6: Send Original Documents to Buyer

This includes:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Fumigation Certificate

- Phytosanitary Certificate

- Certificate of Origin

Important Considerations When Exporting Fresh Bananas

When exporting fresh bananas, businesses must pay close attention to several important factors to ensure product quality and meet international standards.

First, regarding packaging and transportation conditions, green bananas should be packed in 40Rf refrigerated containers with the temperature maintained at 13°C. Ventilation conditions must reach 25CBM to ensure quality during transportation.

In terms of quality standards, the bananas must be intact, without bruising, breaking, or rotting. Bananas should not be sunburned, blackened, or sticky with sap. The harvesting ripeness should be between 75-85%, and the fruit length must not be less than 13cm.

The skin and stem of the bananas must be fresh, dry, and clean. When preparing bananas for export, they should be cut into bunches close to the stem, and the stalk of the banana cluster must be dry. Bunches with partially rotted stems or remaining plant stalks will not be accepted.

Lastly, exported bananas must meet the importing country’s inspection requirements and be free from pests and diseases as stipulated in the contract.

Through this article, we have explored the details about fresh banana export procedures. Let’s work together to build a strong and professional fresh banana export industry. With over 13 years of experience in the logistics sector, we are proud to accompany you on your journey to bring your goods to the world.

Hotline: + 84 935 766 039 to know more about our services

If you require assistance with international import and export of goods, please contact our team at Smartlink Logistics. We are available to provide you with professional guidance on our services and the necessary customs procedures.

SMART LINK: BEST SERVICE BEST YOU