CO FORM AI – IMPORTANT NOTES ON CERTIFICATE OF ORIGIN FORM AI

If you are exploring or working in the field of import-export or international trade, a Certificate of Origin (CO) is an indispensable document. CO certificates come in various forms, such as CO Form A, CO Form D, CO Form E, and many more. In this article, Smart Link Logistics will help you understand CO Form AI and the important considerations related to this form.

1. What is CO form AI?

The Certificate of Origin Form AI (C/O Form AI) is a type of origin document applied to goods originating from Vietnam and exported to India and ASEAN member countries, based on the ASEAN-India Free Trade Agreement (AIFTA).

To clarify, AIFTA stands for the ASEAN-India Free Trade Agreement, which is a trade agreement signed between ASEAN member countries and India on August 13, 2009, under the Association of Southeast Asian Nations (ASEAN).

Once goods are issued a C/O Form AI, they will benefit from the trade preferences under the Comprehensive Economic Cooperation Agreement between ASEAN and the Government of India.

In simple terms, when you export from Vietnam to India with a C/O Form AI, you will be exempt from taxes, and the importer in India will also benefit from tax advantages. This can save you a significant amount of money.

To qualify for preferential import tariffs under AIFTA, goods must meet the following requirements:

- Goods must be listed in the special preferential import tariff schedule issued for each country under the agreement.

- Both the exporting and importing countries must be members of AIFTA, including: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, India, and Vietnam (goods must be directly transported from the exporting country to the importing country).

- Goods must comply with the rules of origin under the agreement and have a C/O Form AI.

2. Documents required for applying for the Certificate of Origin form AI

Applying for a C/O Form AI requires a detailed and thoroughly prepared dossier to ensure a smooth and quick process. The dossier includes:

- Application for C/O:

This is a pre-designed form where you need to fill in all required information. The application must have the company’s signature and seal to ensure its legality.

- C/O Form AI:

This is the specific C/O form for goods exported to India. The dossier includes the original and two copies to be sent to the C/O issuing authority for record-keeping. Ensure that the information is filled out correctly and specifically in English. All copies must be marked in red and signed by an authorized person.

- Commercial Invoice:

The commercial invoice is a crucial document and must be issued in original form. It should be issued by the exporting company.

- Customs Declaration:

The customs declaration must be in original form, with a red seal and the signature of an authorized person at the company. A copy of the customs declaration must also be attached.

- Copy of the Bill of Lading:

For the bill of lading, a certified copy is sufficient if the exporter does not have the original.

- Regional Value Content Calculation Sheet:

The information and calculations in this sheet must reflect the actual regional and specific timing (at the time of dossier preparation).

- Detailed List of HS Input Materials:

These are documents related to materials used in the production of exported goods. Valid documents may include copies of purchase contracts for materials or invoices related to the purchase of materials for production. If there is no contract or invoice, a confirmation from the material supplier is required.

- Copies of Import Customs Declarations for Materials, Production Process of Exported Products, and Other Documents:

Depending on the C/O issuing authority’s requirements, additional documents such as the original packing list, bill of lading, import customs declaration, production process explanation, and other relevant documents may be needed.

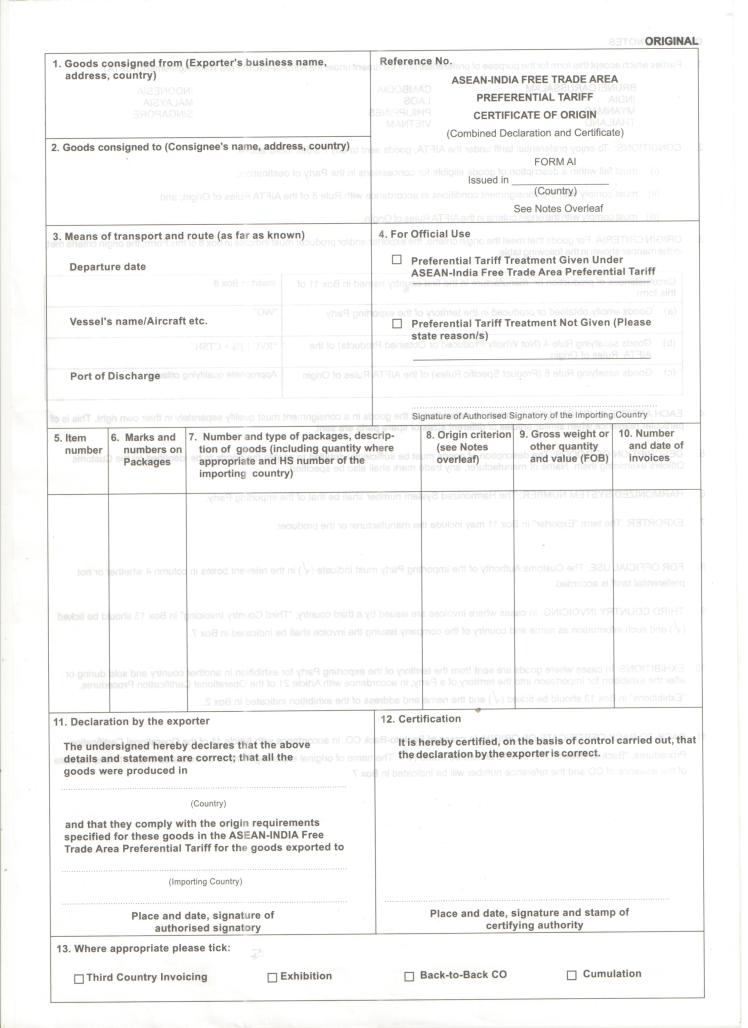

3. Content of CO Form AI Declaration

When declaring C/O Form AI, pay attention to each field and provide specific information as follows:

- Box 1: Enter information about the exporter, including the name, address, and country.

- Box 2: Enter information about the consignee, including name, address, and country. If a prior consignee address is known, you can enter “TO ORDER” or “TO ORDER OF.”

- Box 3: Enter information about the transport unit, including the type of transport, means of transport, voyage number, routing, port of loading, and specific date.

- Box 4: Enter information about the C/O issuing authority, including the name, address, phone number, and contact details.

- Box 5: Enter relevant notes related to the C/O issuing authority. If the C/O is issued after shipment, it must be marked accordingly. If the original is lost, mark the copy or request a replacement C/O.

- Box 6: Enter information about the goods, including item marks, quantity, and type. Clearly and accurately enter information about the numbers or dates. If the declarant is not the main exporter, enter the declarant’s details.

- Box 7: Enter the quantity of goods and net weight. Provide the net weight of the goods, and if necessary, add the HS code of the goods in the importing country.

- Box 8: Enter information about the export invoice, including invoice number and date. If there is no invoice, specify the reason.

- Box 9: Enter the issue date of the C/O. The issue date must be accurate, and if it’s a holiday or weekend, do not enter the issue date.

- Box 10: Enter information about the country the goods are exported to, including the consignee’s address. Also, enter the specific date.

- Box 11: Enter the following lines:

First line: “VIETNAM”

Second line: Name of the importing country

Third line: Address, date, and signature of the issuing or authorized body.

- Box 12: Generally left blank or marked “ISSUED RETROACTIVELY” in specific cases. Mark “CERTIFIED TRUE COPY” as required by Article 7, Clause 4, or Article 8 if applicable.

- Box 13: Check the appropriate box “Third-Country Invoicing,” “Exhibition,” or “Back to back C/O” as per the situation.

This detailed information on CO Form AI (Certificate of Origin Form AI) provided by Smart Link Logistics aims to be helpful. If you need assistance with certifications, logistics documentation, or import-export processes, choose Smart Link Logistics.

Hotline: + 84 903 354 157 to know more about our services

If you require assistance with international import and export of goods, please contact our team at Smartlink Logistics. We are available to provide you with professional guidance on our services and the necessary customs procedures.

SMART LINK: BEST SERVICE BEST YOU