CHEMICAL IMPORT PROCEDURES AT SMARTLINK

Chemicals are a special category of goods in import-export activities, and not all types of chemicals can be imported. So, what does the procedure for chemical importing involve? Let’s explore with Smart Link through the article below!

Information About Chemicals

According to Article 4 of the Chemical Law issued in 2018, chemicals are generally defined as elements or compounds extracted or synthesized from natural or artificial raw materials. Each type of chemical is assigned a unique identification number when imported, known as the Chemical Abstracts Service (CAS) number.

Additionally, in international trade activities, besides mandatory documents such as invoices, sales contracts, and packing lists, you will need a Material Safety Data Sheet (MSDS) for importing chemicals. The MSDS helps you check information about the chemical, its CAS number, and its hazard level.

Types of Chemicals for Import

- Prohibited Chemicals

Chemicals prohibited from import are listed in Appendix III of Decree 113/2017/ND-CP. These chemicals are typically highly hazardous, such as Sarin and Tabun, which are 26 times more lethal than Cyanide. However, in emergency cases requiring these chemicals for scientific research or national defense, approval from the Prime Minister through a proposal by the Ministry of Industry and Trade is required. - Restricted Chemicals

Appendix II of Decree 113/2017/ND-CP details the chemicals restricted from import. To import these chemicals, you must obtain a license from the Ministry of Industry and Trade. Examples include Cadmium Sulfide and Nicotine. - Chemicals Requiring Declaration

Appendix I of Decree 113/2017/ND-CP outlines chemicals that need to be declared during the import process. Previously, businesses had to submit declarations directly to the relevant authorities. However, the process has now been simplified, allowing online declarations via the national electronic portal. Examples include Hydrochloric Acid and Silver Nitrate. - Commonly Imported Chemicals

These are chemicals not listed in the above categories. However, it is essential to cross-check the CAS number with those listed in the mentioned groups before importing.

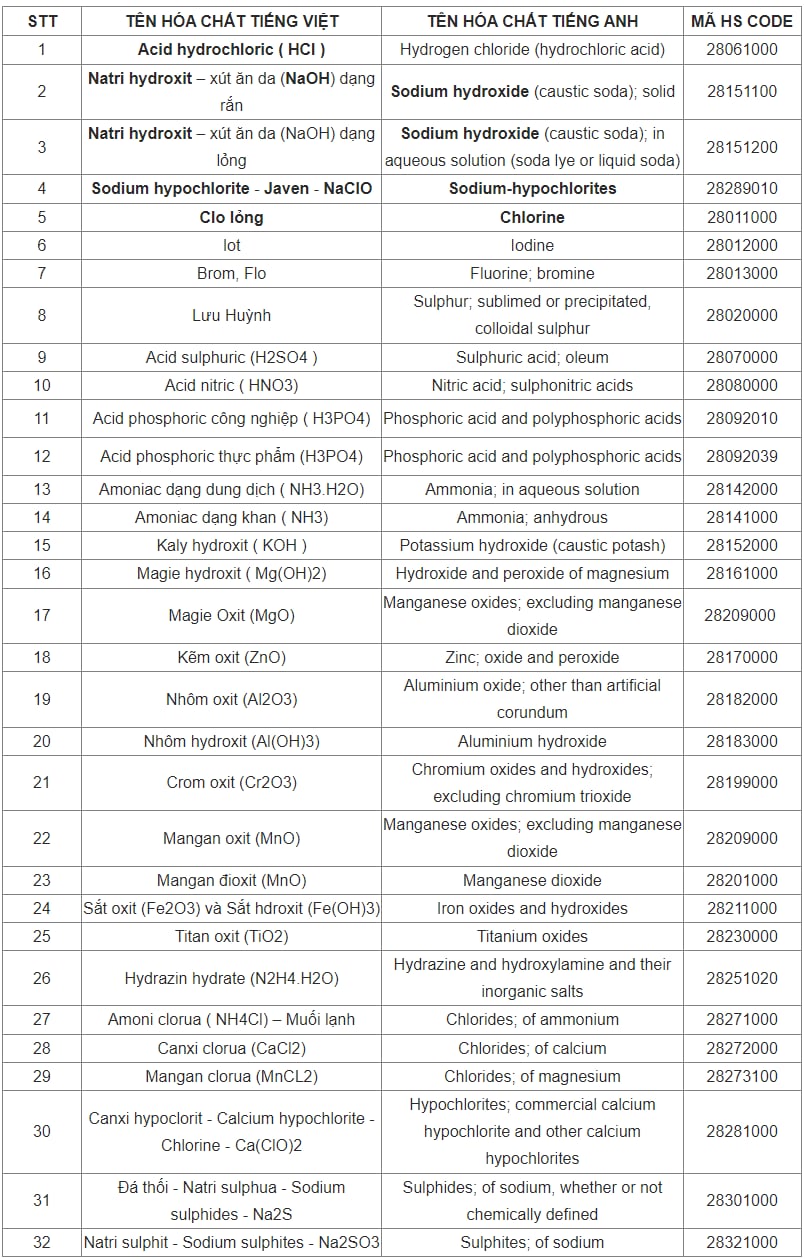

HS Codes

Various chemicals are imported into Vietnam, each assigned a different HS code. You can refer to the HS codes of commonly imported chemicals.

Chemical Import Process

The process for importing chemicals into Vietnam includes:

- Check the CAS number for the chemical shipment and cross-reference it with the chemical lists.

- Declare the shipment upon arrival at the port.

- Print the declaration confirmation and submit it with customs documents.

- Complete customs clearance for the shipment.

Chemical Declaration Process

- Prepare the necessary documents, including:

- Commercial Invoice

- Chemical Declaration Form

- MSDS for hazardous chemicals

- Register an account on vnsw.gov.vn.

- Declare the chemicals online via the national single window portal.

Import Documents

Documents required for importing chemicals include:

- Commercial Invoice

- Sales Contract

- Packing List

- Bill of Lading

- Certificate of Origin (C/O)

- CAS List

- Import business license

Ensure the chemical information sheet includes the scientific name, uses, composition, etc. The free storage period for imported chemical containers is short, so prepare all documents accurately to avoid additional costs.

Smart Link hopes this information on chemical import procedures is helpful. We are committed to providing services and solutions to help your goods reach global markets with dedication and partnership with customers. With over 13 years of experience in logistics, we pride ourselves on being a reliable and professional service provider.

Hotline: + 84 935 766 039 to know more about our services

If you require assistance with international import and export of goods, please contact our team at Smartlink Logistics. We are available to provide you with professional guidance on our services and the necessary customs procedures.

SMART LINK: BEST SERVICE BEST YOU